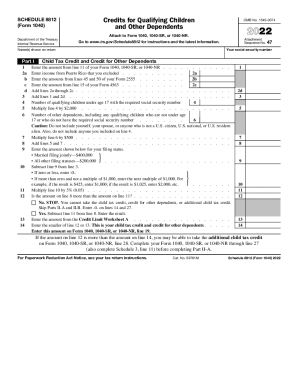

Child Tax Credit 2024 Taxes Form 8812 – the IRS website You have a modified adjusted gross income, or MAGI, of $200,000 or less, or $400,000 or less if you’re filing jointly. Note: . If you have children and a low tax bill, you may need IRS Form 8812 to claim all of your Child Tax Credit. • The Child Tax Credit (CTC) is worth up to $2,000 per qualifying child (tax year 2022). .

Child Tax Credit 2024 Taxes Form 8812

Source : www.investopedia.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

What is the IRS Form 8812? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

IRS 1040 Schedule 8812 2022 2024 Fill and Sign Printable

Source : www.uslegalforms.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

8812104 Form 1040 Schedule 8812 Additional Child Tax Credit

Source : www.nelcosolutions.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024: When will Child Tax Credit start for 2024

Source : www.marca.com

Most Americans feel they pay too much in taxes, AP NORC poll finds

Source : www.8newsnow.com

Child Tax Credit 2024 Taxes Form 8812 Child Tax Credit Definition: How It Works and How to Claim It: The eligibilty limits for the Child Tax Credit are the same as last year but those taxpayers who wre eligible for the bumper payment in 2021 can still file. . The child tax process for tax year 2023 involves filing the federal tax return (Form 1040 or 1040-SR) by April 15, 2024, or by October 2024 with a tax extension. Additionally, taxpayers need to .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)